After working a decade in China I understand one thing – the customer culture is very different from the west. Yet, I realise that it is here growth will occur in the next decade. Companies around us are scrambling to decipher what to keep and when to change as they design for the second largest consumer market in the world.

The most successful companies we work with spend time empathising with their customer segments, embracing their different culture to uncover actionable customer insight that becomes key to drive long term growth. Other companies try easier ways relying on sales figures and other transactional data to point the way but this is less effective.

In a time when big data is the word on everyone’s lips it is easy to underestimate the value of traditional qualitative interviews to complement the long term strategy. The drawbacks to only rely on sales figures or transaction data is that you will only see what is happening in the space you are tracking – now, which means by the time you got your act together and launched the product the opportunity has passed and you end up hitting a segment of late majority, uninspiring consumers not willing to pay the dollars it takes to float your boat.

If you really want to maximise your revenue, you need to arrive early to the market and ride that sales curve as long as possible. This requires you to understand consumer trends before it has happened and the best way to do that is by continuously measuring the consumer drivers, needs and behaviours. This enable you to spot why trends are occurring, which is critical for understanding adoption. With this insight you will arrive early and prepared to drive and ride that sales curve.

A good Customer Insight process should quickly identify segment-specific values, needs, behaviours and attitudes that enable companies to understand what drives a value proposition and what does not. The result is happier customers choosing your products over competitors benefiting both brand loyalty and bottom line.

Here are three large trends we have spotted in 2018 when conducting qualitative in home interviews in China.

Trend 1 – China’s Growing Middle Class will change everything

Now more than ever companies need to understand the economic, social, and demographic changes shaping the profiles of consumers and how they will spend. In Hong Kong we can clearly see how China’s Upper Middle Class is growing though the influx of dollar spending tourists.

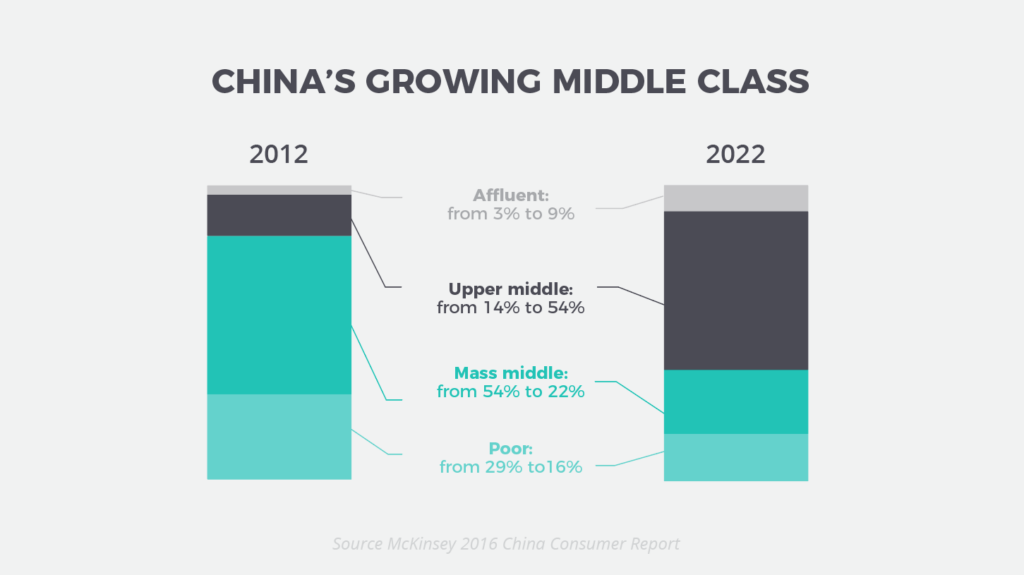

McKinsey predicts major changes in all income levels and the affluent consumer segment is expected to reach 9% in 2022. This segment will have investable asset between 660,000 – 6 million yuan (USD 95,000 – 880,000).

The rapid changes and re-construction of the basic market will likely mean that customer segments will undergo real transformation which will require close monitoring to keep up with the changing needs and desires of multifaceted target customers, each with unique characteristics that determine their shopping habits. Forget Millennials, GenZ or what ever we call it in the west. Change in China happen faster. Here they are called post-80s, post-90s and post-00s.

2017 per household disposable income in urban environment in Eastern China is around 39,651 CNY. That will be close to South Korea’s current standard of living but still a long way from its level in some developed countries like Japan or US. It means companies will be able to introduce better products to a large group of consumers.

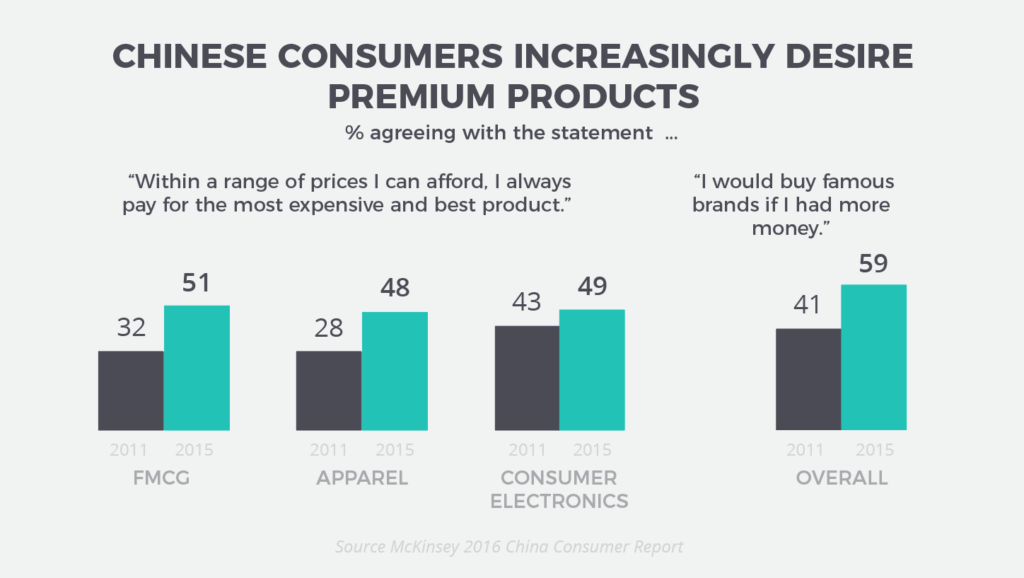

In Hong Kong and Shenzhen we frequently bump in to ‘brand scouts’ trying to ride the wave of spending consumers. They are looking to score strong western brands they can sell in the many malls that are increasingly feeling the competitions, and they are looking to differentiate themselves by offering unique experiences for an increasingly sophisticated consumer seeking brands that deliver value for money.

Bottom line. Keep you eye on your target consumer. Their preference will likely change faster than you will be able to transform the offer.

Trend 2 – The environment is on everyone’s mind

In our most recent interview round in three cities in China with middle to high income class we saw it again, a very high scores in environmental awareness. The past year we have seen this similar result in our studies.

The environment is on every ones mind now and creating a direct impact on consumers life and they are reacting to worrying real life situations.

Q – If money is not an issue, what household appliances would you go out to buy for yourself?

A -“Air purifier! The one we have is RMB2000-3000, I will purchase one that is RMB20,000!”

According to the Report on Consumer Awareness and Behaviour Change in Sustainable Consumption released by the China Chain Store & Franchise Association is

- about 50% of Chinese consumers were willing to pay 10% more for sustainable products or services than non-sustainable ones.

- More than 70% of Chinese consumers understood sustainable consumption, meaning buying products or services that have the least pollutants and do minimum harm to the environment.

- Young people in the 20-29 age group showed strong awareness and willingness for sustainable consumption, whereas the 30-40 year old consumer group has the strongest sustainable consumption ability.

- The environmental sustainability characteristic of a product is only ranked after personal health and safety. About 62% of Chinese consumers chose “Safety and health” as the top driving factor for purchasing sustainable or green products or services. About 50% of Chinese consumers indicated environmental-friendliness as being the next reason.

Download the PDF here (only in Chinese)

The importance can also be seen in the budget strategy from the Central Governments. Sustainable production and consumption is part of China’s national strategy in its 13th Five-Year Plan (2016-20).

I’m careful with my statement, but we may be seeing a tipping point.

Trend 3. The fight for China’s talent has begun.

In Shenzhen you find some of China’s absolute top tech giants, the most advanced production mixed with China’s highest GDP. Service innovations in the city has in some places surpassed the most advanced cities in the western hemisphere.

Shenzhen owes its success not to the government or the Communist Party but to its policy of allowing people to go “beyond the planned economy”and its relationship to Hong Kong. It spends over 4% of its GDP on research and development (R&D), double China’s average. It also houses China’s larges percentage of private companies that thrive by escaping the bureaucracy of Beijing.

China Greater Bay economic cluster is predicted to emerge as the largest ‘bay area’ economy in the world by 2030, consisting of 78 million people and with a combined GDP of 1,4 trillion USD. Hong Kong will need to scramble to quickly identify its competitive offer outside its traditional offer of western culture, freedom of speech, finance centre, common law and English speaking workforce.

This summer Hong Kong introduced a relaxed immigration policy that aims to draw in global talent who can support the city’s development as a ‘high value-added and diversified economy’. It recently published a list of 11 types of occupations that will get a priority to live in the city even if they do not have a job lined up.

This list powers up experts specialized in waste treatment, Cyber Securities, Creative Industries, and Life Science. Full list

Richard Florida – American economist and social scientist wrote about the importance of attracting the creative class. The innovators themselves who will look for similarly minded people to connect with. In Hong Kong we are seeing theory turning in to practice.

The fight to attract the best global talent is on and Hong Kong does not want to lose out!

In conclusion

The changes in China’s demographic construction is happening fast and will require close monitoring in coming years. Something that works today will likely to change tomorrow. Companies will need to hone their skills to predict change before it happens.

Great nations rise and fall from within. Pollution poses not only a major long-term burden on the Chinese public but also an acute political challenge to the ruling Communist Party.

China is breaking out from low cost manufacturing and transforming its role on the value chain attracting top-level knowledge workers in the process. Although not yet innovators due to risk adversity and deep rooted organisational hierarchy preventing new ideas to surface, we are definitely seeing progress in attitudes towards innovation.

Written by Johan M Persson

Founder of C’monde Studios. Hong Kong